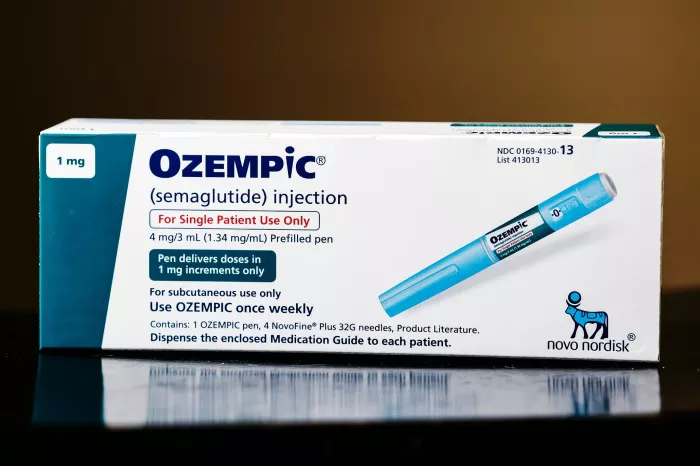

With obesity rates steadily climbing, China is facing a growing health crisis. Projections indicate that by 2035, medical costs related to obesity – associated diseases could account for 20% of the total medical insurance expenditure. Meanwhile, anti – obesity medications come with a hefty price tag. For instance, without insurance coverage, Wegovy by Novo Nordisk costs $1,349 per month, and Ozempic costs $935.77 per month. These prices are significantly higher compared to $92 and $59 in Europe, respectively, making long – term use unaffordable for many patients. Moreover, health insurance coverage for these drugs remains limited in many countries.

Against this backdrop, the government aims to address the obesity problem by promoting nutritional products. However, this transition has encountered numerous challenges. China’s “National Weight Management Year” policy has drawn public attention. The policy seeks to encourage proactive health management through market – driven approaches, aiming to ease the burden on the medical insurance system. Initiatives such as setting up weight management clinics in hospitals and promoting low – calorie meals in schools have been implemented, with the medical and education sectors responding actively. Unfortunately, the nutritional health industry has been slow to react, and companies have yet to fully capitalize on the opportunities in the weight – loss market.

Several contradictions within the industry are hindering the promotion of nutritional products. In terms of the legal framework, China’s Food Safety Law classifies nutritional products as food items. Even if companies have substantial scientific evidence of their products’ efficacy, they are prohibited from making relevant claims. For example, a company that invested tens of millions of yuan in developing a nutritional product for liver fat reduction faced significant difficulties in marketing due to regulatory restrictions, dampening the enthusiasm for research and development. On the consumer side, 65% of consumers view nutritional supplements as a “scam” due to a lack of scientific communication, resulting in widespread confusion about the necessity, proper use, and long – term safety of these products. In terms of technical approaches, existing weight – loss methods have limitations. Traditional methods are less effective for “hidden obesity,” and current nutritional health products for weight loss mainly consist of basic supplements like protein powder and vitamins, lacking precise and evaluable intervention programs.

Promoting nutritional products also faces practical difficulties. Take wholegrain products as an example. Due to insufficient public awareness, market demand remains limited, reducing manufacturers’ incentives to produce high – quality products. The regulatory system also requires improvement, with standards and quality management needing further enhancement. Additionally, wholegrain foods have drawbacks in cooking, taste, and digestion. They often have a rough texture, and some people may experience digestive discomfort after consumption.

Amid rising obesity rates and costly anti – obesity drugs, the government’s efforts to promote nutritional products have hit a snag. Urgent action is needed to synchronize policy innovation with industry upgrades in the nutritional health sector, establish a scientific “nutritional weight – loss” technical system, enhance consumer education, and improve relevant regulations and standards. Only then can nutritional products play an effective role in preventing and controlling obesity.

Related topics: